Silicon photonics 300-mm wafer. [Image: Ehsanshahoseini/Wikimedia Commons; CC BY-SA 4.0]

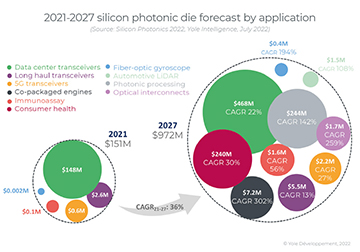

A recently published report from Yole Intelligence, the market-analysis arm of the France-based international research firm Yole Group, projects that the value of the silicon photonics market, at the die level, could balloon from an estimated US$152 million in 2021 to US$972 million in 2027. That amounts to a blistering compound annual growth rate (CAGR) of 36%—likely to be driven, Yole believes, both by ongoing growth in the core data communications market and by emerging areas such as consumer health, automotive lidar and AI.

Impressive as the numbers sound, the market growth expectation is actually somewhat tempered from a similar report from Yole last year, in which the firm projected a US$1.1 billion die-level silicon photonics market by 2026.

Data centers: Increasing integration

Looking at communications markets in particular, Yole expects that the silicon photonics share of the optical transceiver market, estimated at more than 20% today, could expand to around 30% by 2027. Key drivers for increased integration, according to the company, should be the evolution by data centers into 400G and 800G pluggables; an increased use of coherent technology in datacom applications; and a demand for 400ZR-standard-compliant technology. All of this could, by Yole’s reckoning, move the market for data center transceivers alone from US$148 million in 2021 to US$468 million by 2027.

The firm also sees a trend toward “disaggregated” data centers, built on optical interconnects partly enabled by silicon photonics. Such architectures could prove key to providing more power and efficiency for high-performance computing and data communications. One company Yole cites is Ayar Labs, which is building a business premised on photonic interconnects for application-specific integrated circuits (ASICs) in data centers—and which, Yole notes, is “planning its first shipments in 2022.”

Emerging application areas

[Source: Yole Group] [Enlarge image]

The growth in integrated interconnects is, according to Yole, only one example of an emerging application area that will help drive the silicon photonics market of the future. For instance, the Yole numbers also envision a ramp-up in silicon photonics for co-packaged optics (CPO) in data centers from virtually zero in 2021 to around US$7.2 million in 2027. While the company acknowledges that such growth is “an open question,” its report argues that silicon photonics is “the right technology to be the missing link between CPO and pluggable because of its integration capability.”

Another new application areas that Yole calls out is silicon photonics for consumer health devices, for which the company sees the market swelling at a 30% CAGR, to US$240 million, by 2027. On that head, the report specifically cites the likely shipping by Rockley Photonics of its VitalSpex biosensing unit over the next year or so, which could presage the appearance of silicon photonics–based sensors in wearable technology “from large brands like Apple or Huawei.” Yole envisions an even more eye-watering CAGR of 142%, to US$244 million, for photonic processors for AI and other high-end computing applications.

Still, in a number of cases, the brisk application potential signaled in Yole’s 2022 report represents something of a walk-back from the even more optimistic numbers framed in the report’s 2021 version. The 2021 study, for example, looked for the silicon photonics die market for consumer health applications to reach US$478 million by 2026, far above the US$240 million the firm is now projecting for 2027. On the other hand, the 2021 report targeted of a US$115 million silicon photonics market for “photonic computing” by 2026, versus the 2022 report’s rosier expectation of US$244 million for “photonic processing” in 2027.

A changing industry

All of this application growth, Yole observes, is affecting an industry that itself is in an ongoing state of flux. The huge new application potential, the company says, has spawned a raft of start-up firms in the past several years. But, at the same time, the industry continues to see acquisition activity and consolidation as big players work to build scale. Yole notes that China in particular is actively working to stand up “a complete silicon photonics industry … including silicon-on-insulator (SOI) suppliers, start-ups, and large companies.”

Yet the report also stresses that silicon photonics will increasingly need to look beyond SOI, and toward other, more cost-effective CMOS-compatible technologies that play better with photonics. Among the materials now being explored to overcome some current bottlenecks are lithium niobate thin films, indium phosphide, barium titanate, polymer and plasmonic materials, according to Yole.

“As integrated optics moves towards increased functionality, the definition of silicon photonics will expand to include the integration of other materials,” the company writes. “However, a CMOS manufacturing environment remains necessary for the cost benefit.”