[Image: Getty Images]

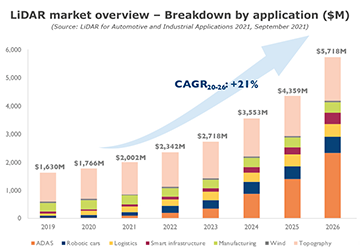

The market research firm Yole Développement forecasts automotive and industrial applications will take the worldwide lidar market from US$1.8 billion in 2020 to US$5.7 billion by 2026, a compound annual growth rate of 21%.

Yole identified automotive and industrial technologies as “key enablers” for its projected lidar market growth over the next five years. Within the automotive sector, the firm’s analysts named advance driver assistance systems (ADAS) and robotic cars as the two applications with the biggest expansion potential. On the industrial side, smart infrastructure and logistics applications are expected to lead the increase in market volume.

Lidar for smart cars and cities

In 2020, ADAS constituted only 1.5% of the total automotive and industrial lidar market. Yole expects the ADAS market segment to balloon to 44% of the market by 2026, achieving impressive 111% compound annual growth and a US$2.3 billion market value. Lidar for robotic cars, meanwhile, could see respectable 33% compound annual growth rate over the same period, reaching US$575 billion.

[Image: Courtesy of Yole Développement] [Enlarge image]

For the industrial share of the lidar market, Yole believes that the smart-infrastructure segment—for example, smart-city applications including security, highway monitoring and autonomous checkout—could achieve a 35% compound annual growth rate through 2026, reaching a market size of US$395 million. The logistics segment (such as autonomous trucks and delivery robots) is projected to see lower compound annual growth rate, at 23%, but a higher share of the market value, at US$466 million.

Tracking “design wins”

There are more than 80 lidar companies worldwide, making the market technologically diverse. However, according to Yole, the oldest lidar imaging technologies are still achieving the most “design wins” for automotive applications, with mechanical scanning taking 69% of the pie. In its report, the research firm also broke down lidar automotive industry design wins by wavelength and supplier, naming 905 nm (65%) and the French automaker Valeo (28%) as leaders in each category.

The market-research firm writes that emerging imaging technologies for the lidar automotive industry include MEMS micromirror and FLASH applications. For lidar ranging, Yole estimates that frequency-modulated continuous-wave applications—which, the firm says, have the potential to outperform direct time-of-flight ranging in integration, sensitivity and instant radial velocity—will appear on the market soon, but not before 2025.

As for manufacturing, Yole analysts identified 60 players in the lidar automotive industry, with 14 of these already having “design wins with car maker OEMs.” They see the number of manufacturers reduced to the single digits as the market matures over the next five years. The reduction in numbers, the firm says, will be the result of acquisitions as well as dissolutions due to lack of funding.

Yole notes that software and computing manufacturers will prove integral to developing the lidar supply chain for smart cars. The market research firm suggests that the largest OEMs will develop software for advanced automated driving features through partnerships or acquisitions. Smaller OEMs are expected to develop basic automated-driving features using tier-1 suppliers. Semiconductor companies will position themselves to be at the center of automated-driving systems, according to Yole, and consumer companies will enter the automotive market by developing self-driving features or their own autonomous vehicles.