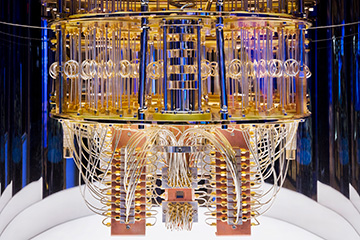

Interior of IBM’s superconducting-qubit quantum computer. [Image: IBM Research / Flickr; CC-BY ND 2.0]

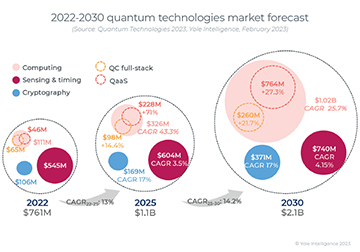

A new report from the research firm Yole Intelligence, a branch of the France-based Yole Group, projects that the worldwide market for quantum technologies will expand from an estimated US$761 million in 2022 to US$2.1 billion in 2030.

Further, while the study envisions growth in all three major segments—computing, sensing and communications/cryptography—it argues that quantum computing will “dominate” the segment’s revenues looking past 2030. Indeed, Yole projects that by 2035, the quantum-computing market alone will total some US$4.1 billion, nearly twice the projected 2030 total for all quantum technologies.

QaaS ascendant?

Yole’s expectations for the quantum-computing market rest on its bullish view of “quantum as a service” (QaaS), in which quantum hardware, software and support are packaged into cloud-based installations and sold as a service to end users. The new study maintains that the QaaS market could swell from an estimated US$46 million in 2022 to US$228 million by 2025 and and US$764 million by 2030.

The market for quantum hardware, Yole believes, will expand at a slower but still respectable pace, from US$65 million in 2022 to US$98 million in 2025 and US$260 million in 2030. Among hardware makers, the company sees a trend toward “a ‘full-stack’ approach from the quantum chips to the computer software/service level”—an approach that, the company adds, is not open to everyone, as it calls for “significant R&D manpower, budget and effort.”

Sensing and cryptography prospects

[Image: Yole Intelligence] [Enlarge image]

As the Yole report notes, today’s largest quantum market segment by far is not computing but quantum sensing, for applications such as gravimeters and atomic clocks. That market weighed in at US$545 million in 2022, by Yole’s reckoning, and thus accounted for more than 70% of the total quantum-tech market. But the firm believes sensing’s future market growth will far trail that of quantum computing; the study projects that the 2030 quantum-sensing market will weigh in at around US$740 million.

The market for quantum cryptography, meanwhile, could more than triple, from an estimated US$106 million in 2022 to US$371 million by 2030, according to Yole, considerably outpacing the percentage gains in sensing. Study author Eric Mounier notes that the cryptography market is partly driven by advances in quantum computing.

“As quantum computers become readily available, they will be able to break the current integrity keys used for data exchange,” Mounier writes. “This creates a direct connection to quantum cryptography, and post-quantum approaches are being developed to prevent future hacking by quantum computers (communication, bitcoins, cryptocurrency, etc., could also be compromised by quantum computers).”

An industry in flux

The Yole report also highlights the coalescence of a “quantum ecosystem” and an emerging supply chain for quantum tech. It sees “the involvement of semiconductor players (GlobalFoundries, TSMC, X-FAB, Intel, etc.), photonics (Ligentec), and equipment makers (Keysight, Formfactor, Oxford Instruments, AMAT, etc.)” as forming “a robust technological base,” but also observes that partnerships are essential given the early-stage nature of the technology. The emergence of a quantum ecosystem is also evident, Yole says, in active research collaborations, startup activity and expanding patent portfolios (in which, according to the firm, “China is currently dominant”).

The study also depicts an industry in a state of considerable technological flux. “Technology choices are not yet fixed,” the firm says, with many choices for the quantum bit (qubit) architecture ranging from superconducting qubits to trapped ions—each with strengths and weaknesses. “There will be multiple approaches for multiple applications, mixing different technologies,” Yole predicts.

Yole acknowledges that quantum computing is still at an early stage—a “time of annealers and NISQ [noisy intermediate-scale quantum] with no practical use case”—and that the segment is subject to “technological and timing uncertainty.” But the study ultimately envisions a compelling long-term future. “Although quantum computing will not be commercially usable until after 2030+,” according to Yole, “the investment time is now.”