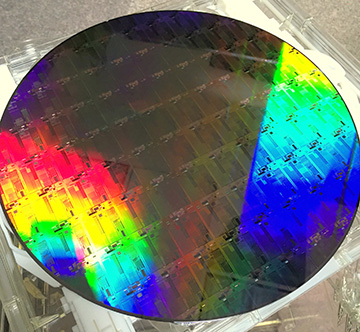

Silicon photonics 300-mm wafer. [Image: Ehsanshahoseini/Wikimedia Commons; CC BY-SA 4.0]

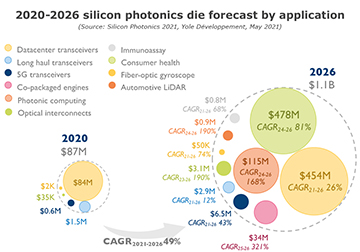

The market-research firm Yole Développement estimates that the silicon photonics die market could grow explosively in the next several years, expanding from around US$87 million in 2020 to some US$1.1 billion by 2026. The company says its forecasts imply a 49% compound annual growth rate for the five years beginning in 2021.

Powered by new applications

Underlying Yole’s optimistic projections is the expected emergence of a wide variety of new applications for the silicon photonics platform. Heretofore, most silicon photonics applications have been in optical communications, and the lion’s share of the die market—some US$84 million of the US$87 million total for 2020—has gone to data center transceiver applications. By contrast, between now and 2026, the company believes that the fastest growth will come in applications in consumer health and photonic computing.

Yole sees particular significance in the increasing interest of Apple Inc. in silicon photonics technology. Apple, the market-research company notes, is now working with the U.S. firm Rockley Photonics, which is developing “clinic on the wrist” photonic modules, built around integrated spectrophotometers, that can measure a number of biological parameters

Yole Développement suggests that such silicon photonic modules could find their way into a new generation of smart watches with health care functions, such as the high-end Apple Watch. That, in turn, could spur silicon photonics die demand for this market segment amounting to US$454 million by 2026, compared with essentially zero in 2020.

[Source: Yole Développement] [Enlarge image]

The computing market for dies, meanwhile, stands to benefit both from the drive toward photonic and quantum computing and the need for optical interconnects between traditional computers in data centers. All of this, according to Yole, could amount to die revenues for the computing segment of some US$115 million by 2020. The company also expects significant growth in smaller market segments in immunoassays and automotive lidar.

And the traditional transceiver business is hardly standing still. Yole estimates that, driven by the new needs of 5G communications, the silicon photonics die market for this segment could expand to US$454 million by 2026, for a five-year CAGR of 26%.

Integration, SPACs and foundries

Yole also points to “three developments … in the silicon photonics industrial landscape” that it believes could shape future competition. One is the increasing shift from pluggable optical transceivers to integrated co-packaged optics (CPO), driven by the advent of 51.2-Tbps network switches by 2025. This could, in Yole’s view, shift market power into the hands of the relatively few highly integrated providers, such as Cisco, Intel and Broadcom, with the technological chops to handle CPO.

A second trend, according to Yole, is the increasing use of special-purpose acquisition companies (SPACs) as a route to public ownership, particularly in lidar and consumer healthcare. These deals, the company points out, can provide substantial volumes of cash for R&D in these expanding areas.

Finally, Yole sees changes ahead in the mix of foundry players serving the silicon photonics market. At present, the company says, while many foundries worldwide offer some kind of manufacturing services in the area, only a few, such as Intel and TSMC, can provide volume production at scale. As the application space for silicon photonics expands, however, Yole says “we are likely to see new foundries announcing volume production in the next couple of years.”

More information on the Yole study can be found at http://ow.ly/rnJn50ETIqR.