![]()

Left to right: Multiverse co-founders Samuel Mugel (chief technology officer); Román Orús (chief scientific officer) and Enrique Lizaso Olmos (CEO). [Image: Multiverse Computing]

As companies, academic research labs and engineers all plow forward toward the goal of scalable, low-noise quantum-computing hardware, questions inevitably arise about the software side. What sort of applications will run on such machines and exploit their claimed advantages over classical hardware?

Some dedicated software/service organizations are emerging that aim to answer that question, plugging into the cloud-based installations that various quantum-hardware companies have started to make available. One such company is the Spain-based startup Multiverse Computing, which is building a suite of software algorithms and interface tools for specific problems in finance and other business areas that can take advantage of even the current crop of early-stage quantum machines.

This week Multiverse unveiled a “Fair Price” addition to its core product, which exploits the IonQ trapped-ion quantum platform—and which the company says can cut error rates on some Monte Carlo simulations (used by financial firms to price securities) by as much as 43% relative to classical machines in the same run time. To learn more, OPN talked with Multiverse co-founder and CTO Samuel Mugel.

Quantum computing for the masses?

Mugel says Multiverse’s mission is to “give access to quantum-computing tools for the masses”—though at present, the masses are rather narrowly defined. Founded in 2019, the company has developed a suite of tools, bundled under the trade name Singularity, that focus on financial-industry problems such as portfolio and capital-allocation optimization, securities pricing and detecting optimal trajectories for investment and disinvestment.

In particular, the company’s goal, according to Mugel, is to “develop use cases that benefit from quantum resources, but that can be used by people in organizations that don’t necessarily have any interest in quantum computing.” Thus, the Singularity product is built on software algorithms targeted to focused financial problems and tailored to specific, cloud-accessible quantum platforms such as the commercial superconducting-qubit, trapped-ion and neutral-atom machines that are increasingly becoming available.

To link these platforms to clients, the company also provides deployment tools, application programming interfaces (APIs) and front-end interfaces and plug-ins based on Microsoft Excel. That’s a package that’s thoroughly embedded in the daily workflow of the typical financial-service employee.

“Quantum-enhanced” securities pricing

For the Fair Price tool, Multiverse draws on an algorithm documented in a paper posted on the arXiv last year. The paper demonstrated a calculation of portfolio value under a model called the Gordon–Shapiro formula, using a “quantum-enhanced” Monte Carlo simulation to estimate the portfolio’s “mean intrinsic value.” Such simulations, a common risk-assessment tool in finance, involve thousands of repeated computational runs of a scenario using different random variables; the result is a probability distribution of potential outcomes. The method is useful but computationally intensive, and is commonly run in parallel-processing mode on an array of classical computers.

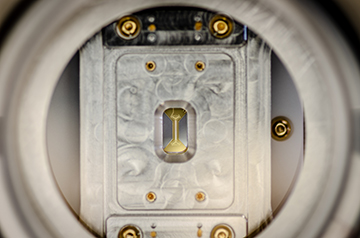

Top view of IonQ ion trap mounted inside of a vacuum chamber. Multiverse’s Fair Price tool uses the trapped-ion platform to run Monte Carlo simulations, reportedly at substantially lower error rates than classical computers given the same run time. [Image: Kai Hudek/IonQ] [Enlarge image]

For its quantum-enhanced version, Multiverse opted to use the IonQ platform, the qubits of which consists of laser-trapped ions. The platform was chosen because the Fair Price tool “needs a platform that’s fully connected, [and] that has very low error rate,” Mugel explains. “The IonQ platform is extremely well suited for this type of computation, just because, even though it doesn’t have many qubits, they’re fully connected and have … world-record error rates, basically.”

In the work reported in the paper, the Multiverse science team found that the process used by Fair Price, leveraging the trapped-ion quantum architecture, could reduce mean errors on such calculations by 43% in bearish market scenarios, 39% in neutral scenarios, and 37% in bullish scenarios, without increasing the number of runs or run times. This, the firm maintains in a press release, lets financial institutions “achieve a more accurate valuation more quickly.”

Mugel does note, however, that the company is being careful not to claim “quantum advantage” in this case. That’s because the simulations—while potentially more accurate in less time on the quantum platforms—still can be (and are) run on classical machines, and the error rates on quantum hardware are still too high to reach the number of sample runs required to demonstrate true quantum advantage. But he believes the fair-pricing problem is “a really interesting demonstration of where quantum advantage could come from,” Mugel believes, as better, lower-noise quantum machines are developed and come to market.

Exploring other markets

Right now, Multiverse’s main offerings appear to lie in the area of optimization problems, which have emerged as a sweet spot for the current generation of relatively noisy, limited-scale quantum hardware. Mugel says the company’s “star product” is a portfolio-optimization tool, which can be run on the D-Wave quantum-annealing tool (if the client is looking for a fast answer) or on a proprietary Multiverse “tensor networks” tool (if the client is looking for the most accurate possible solution).

As to its client base, Multiverse is currently working Crédit Agricole Group, France’s second-largest bank; Argentina’s Banco Bilbao Vizcaya Argentaria (BBVA), one of the world’s largest financial institutions; and “other major firms in the financial industry,” according to a company press release. Mugel says the startup is looking at a range of other problems for this financial-services base, such as exotic options pricing. And it’s exploring ways to export the technology to business sectors outside of financial services.

“We’re developing some fantastic stuff,” Mugel says, noting that the firm is working on adapting its quantum-enhanced portfolio optimization tool for a petrochemical/energy company that hopes to solve problems in optimizing energy management and distribution. “And we’re looking at several really interesting optimization [and] machine-learning problems within manufacturing,” he says.