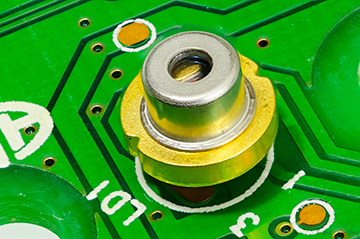

A laser diode from a laser printer. [Image: Tudor Barker/Flickr; CC-BY-NC-SA 2.0]

A recent report from the market-research firm Yole Intelligence, part of the France-based consultancy Yole Group, predicts startling growth in the market for edge-emitting lasers (EELs) over the next five years. According to Yole, worldwide demand for EELs could more than double from US$3.5 billion in 2021 to US$7.4 billion in 2027, a compound annual growth rate (CAGR) of 13%.

While Yole believes the market for these lasers will continue to be dominated by optical-communications and (to a lesser extent) materials-processing applications, the company sees the potential for rapid expansion in niche applications in sensing, medical devices and lighting. On the other hand, Yole’s numbers suggest that several traditional laser-diode applications, including printing and optical data storage, are dwindling into irrelevance as markets for EELs.

Complicated market

EELs, as the name implies, are semiconductor lasers on which light propagates horizontally along the surface of the chip, and is emitted or coupled out at the edge. They are distinct from surface-emitting lasers such as VCSELs, in which the propagation direction is perpendicular to the wafer surface.

Yole characterizes EELs as “complex photonic devices” that can embody a variety of resonator designs and packaging types for different applications. As such, the industry is, according to the firm, “highly fragmented and diversified,” and thus a challenging segment in which to do business—with multiple applications often requiring unique specifications, with stiff competition between different EEL technology platforms, and with supply and value chains specific to each application.

Communications dominant

Notwithstanding those complications, Yole looks for significant gains for EELs in a number of broad markets. The biggest expansion, according to the firm, could come in optical communications, which accounts for more than two-thirds of the total EEL market and for which Yole sees EEL demand burgeoning at a CAGR of 15%, from US$2.38 billion in 2021 to US$5.62 billion in 2027. Driving that demand will be continued growth in such bread-and-butter products as optical modules for data communications and telecommunications, according to Yole.

The biggest expansion could come in optical communications, which accounts for more than two-thirds of the total EEL market and for which Yole sees demand burgeoning at a 15% CAGR.

EEL market growth is apt to be much slower in the second-biggest segment, materials processing. Here, Yole looks for revenues to climb from US$509 million in 2021 to US$674 million in 2027, a CAGR of only 5%. In this segment, the firm notes, the leading players tend to be strongly vertically integrated from the EEL through the actual laser machine tool, in line with customer demand for turnkey solutions specific to the manufacturing issue being solved.

Demand for EELs in displays, the third-largest market segment for these lasers, could expand a respectable 7% per year, by Yole’s reckoning, moving from US$352 million in 2021 to US$535 million in 2027. On the other hand, demand for traditional EEL applications such as laser printers and optical storage could waste away to only US$50 million by 2027, versus US$95 million in 2021, according to Yole.

“Plenty of challenges”

Perhaps most intriguing is the growth that Yole envisions for EELs in some emerging applications, including automotive lighting, medical devices and 3D-sensing applications such as lidar. The company believes these EEL markets could boom, moving from a total market value of US$206 million in 2021 to US$493 million in 2027—a CAGR of 16%.

Yole notes that applications in sensing such as lidar, and also optical-communication applications, tend to require that suppliers be vertically integrated up to the module level—“such as an optical transceiver or lidar module.” The company adds that “there are still plenty of challenges to overcome at the device level, including increasing performance, beam shaping, and improving high-volume manufacturing, thus decreasing cost.”

More information on the Yole EEL report can be found at the company’s website.