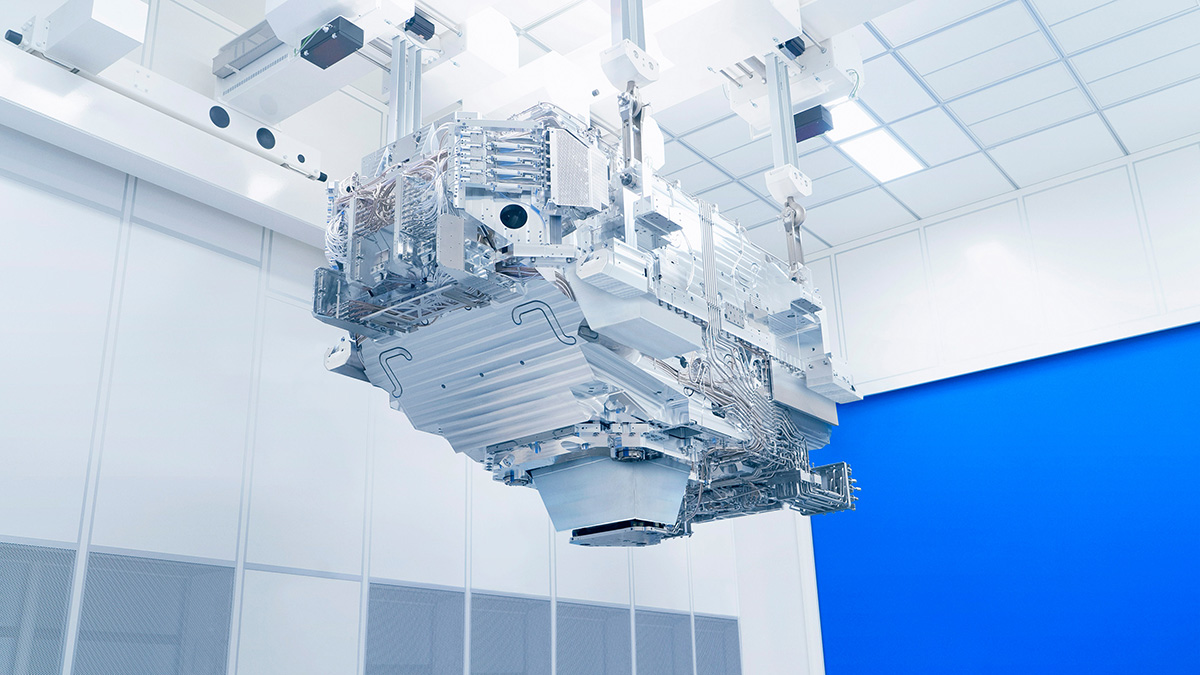

During fiscal 2023, Zeiss’s semiconductor manufacturing technology unit made its first delivery of high-NA EUV optics to key customer ASML. [Image: Zeiss Group]

On 19 December, the behemoth international optics and optoelectronic technology firm Zeiss Group reported that it had booked a 15% year-to-year revenue gain in the fiscal year ended 30 September 2023. The gain brought total corporate revenues to €10.1 billion (US$11.1 billion), the first time in the firm’s history that yearly sales have topped 10 billion euros. Earnings before interest and taxes (EBIT) climbed at a slower rate, reaching €1.7 billion in the September 2023 year versus €1.6 billion in fiscal 2022.

In a press release, Zeiss said the strength was distributed across all four company segments “despite the challenging market environment,” and noted that Zeiss planned significant investments in infrastructure and R&D to keep the momentum going. “To be able to continue on this dynamic growth path in the future,” the company’s president and CEO, Karl Lamprecht, observed in the release, “we need to set the right course now.”

Strength in semiconductor technology

While the company alluded to growth across business lines, some appear to have been particularly strong performers. Zeiss reportedly saw an “exceptionally high revenue rate” in operations related to advanced semiconductor manufacturing, in which the firm provides supplies ranging from lithographic optics to photomasks. Indeed, sales for its semiconductor manufacturing technology business unit ballooned by 29% in fiscal 2023.

The company said it had benefited from strong demand for deep-UV (DUV) and extreme-UV (EUV) lithography systems generally. Another source of new business has been the move of key customer ASML toward producing next-generation, high-numerical-aperture EUV systems, to move the EUV lithography business further forward. Zeiss said it had made its first delivery of high-NA EUV optics to ASML during the 2023 fiscal year.

Zeiss reportedly saw an “exceptionally high revenue rate” in equipment related to advanced semiconductor manufacturing.

Zeiss also reportedly experienced “significant double-digit growth” in its industrial quality assurance and microscopy systems businesses. It saw double-digit gains as well in medical technology, where the company says it benefited from more stable supply chains and better deliverability of ophthalmology and microsurgery products late in the year.

The consumer business seems to have shown a more mixed picture, as the inflationary environment led to a “reluctance to spend” among end consumers. In some areas, such as ophthalmic lenses and eye health, Zeiss said it was able to achieve growth through innovation. But other consumer products encountered a “subdued mood among retailers and consumers,” and the Hollywood strike dented sales in the firm’s cinematic-lens business. The upshot was year-to-year sales growth of only around 4% for Zeiss’s consumer markets unit—though the firm says it’s seeing “slightly positive signals” for the coming fiscal year.

Investing for the road ahead

Meanwhile, Zeiss pointed to various indicators of management’s commitment to investment and development at the company, both in fiscal 2023 and in the years ahead. Around 15% of revenue during the year was plowed into research and development, according to the firm, and its global employee rolls grew by around 11%, to nearly 43,000 persons.

The company’s vision for its future involves “transformation into a data- and process-driven organization.” Toward that end, Zeiss is planning an investment of around €3.5 billion in infrastructure over the next five years, some €3 billion of that in the company’s home base in Germany.

The company’s vision for its future involves “transformation into a data- and process-driven organization.”

The company also made the customary nod to the recent, explosive growth of artificial intelligence, both as a market opportunity and a development tool. “Current devices and software solutions from Zeiss already contain AI components or have been manufactured with them,” the company noted in its earnings release. “There is also a major focus on topics such as intelligent data use or advanced machine-learning methods.”

In summing up its outlook, Zeiss said its business environment is becoming “increasingly challenging,” with geopolitical risk, regulatory complexity and a changing global economy all representing imponderables. “Success in the future,” Lambrecht said in the release, “depends on us continuing to keep an eye on the various risks while, at the same time, realizing our potential and maximizing every opportunity.” That effort, coupled with the company’s ongoing strategic activities, should lead to positive business development in fiscal 2024, according to Lambrecht.